Fiducian Investment Service

The range, variety and investment philosophy of our Fiducian investment funds allows our clients, whether new to investing or highly experienced, turn their hard-earning savings into accumulated wealth to achieve their long-term goals.

Streamline the process

An investment portfolio, whether big or small, needs monitoring and administration: tax reporting, performance analysis, transaction records of investments, dividends and withdrawals. For investors with multiple separate share holdings and managed funds, this can mean a lot of paperwork chasing, especially at tax time. In addition, it can be difficult to get an overall picture of the collective performance of your portfolio.

The Fiducian Investment Service takes all these headaches away, and has many other benefits besides. It’s a streamlined process that lets you and your financial adviser manage all your investments through a centralised portal, and access consolidated reporting.

Benefits of the Fiducian Investment Service

One of the main advantages of investing through Fiducian is the consolidation of assets for your reporting. You receive:

Additional benefits

Cost savings via wholesale fund pricing, which isn’t readily available if you directly acquire managed funds as a retail investor

Cost savings via wholesale fund pricing, which isn’t readily available if you directly acquire managed funds as a retail investor  Your Financial Adviser manages your transactions – you don’t need to do a thing

Your Financial Adviser manages your transactions – you don’t need to do a thing  A cash account where you can park funds while pondering your investment decisions or for the proceeds of any investments you sell

A cash account where you can park funds while pondering your investment decisions or for the proceeds of any investments you sell  Consolidated reporting with half yearly statements

Consolidated reporting with half yearly statements  Our Fiducian Online service enables you and your financial adviser to better keep track of your investment goals via a single access point

Our Fiducian Online service enables you and your financial adviser to better keep track of your investment goals via a single access point  A share administration service if you want to buy or sell shares directly

A share administration service if you want to buy or sell shares directly What investment choices does the Fiducian Investment Service offer?

Over 28 managed funds options from over 18 investment managers, including renowned fund managers such as BT, Platinum and Colonial First State

14 Fiducian funds managed through our proven Manage the Manager system, including diversified, sector and specialist funds

Managed share and listed property securities portfolios that are fully researched for you, have fixed interest securities and term deposits, and margin lending facility

How does the service work?

The Fiducian Investment Service is only available to you through a licensed financial adviser. At Fiducian, we believe in the value of ongoing financial advice and strongly recommend that you keep in regular contact with your financial adviser.

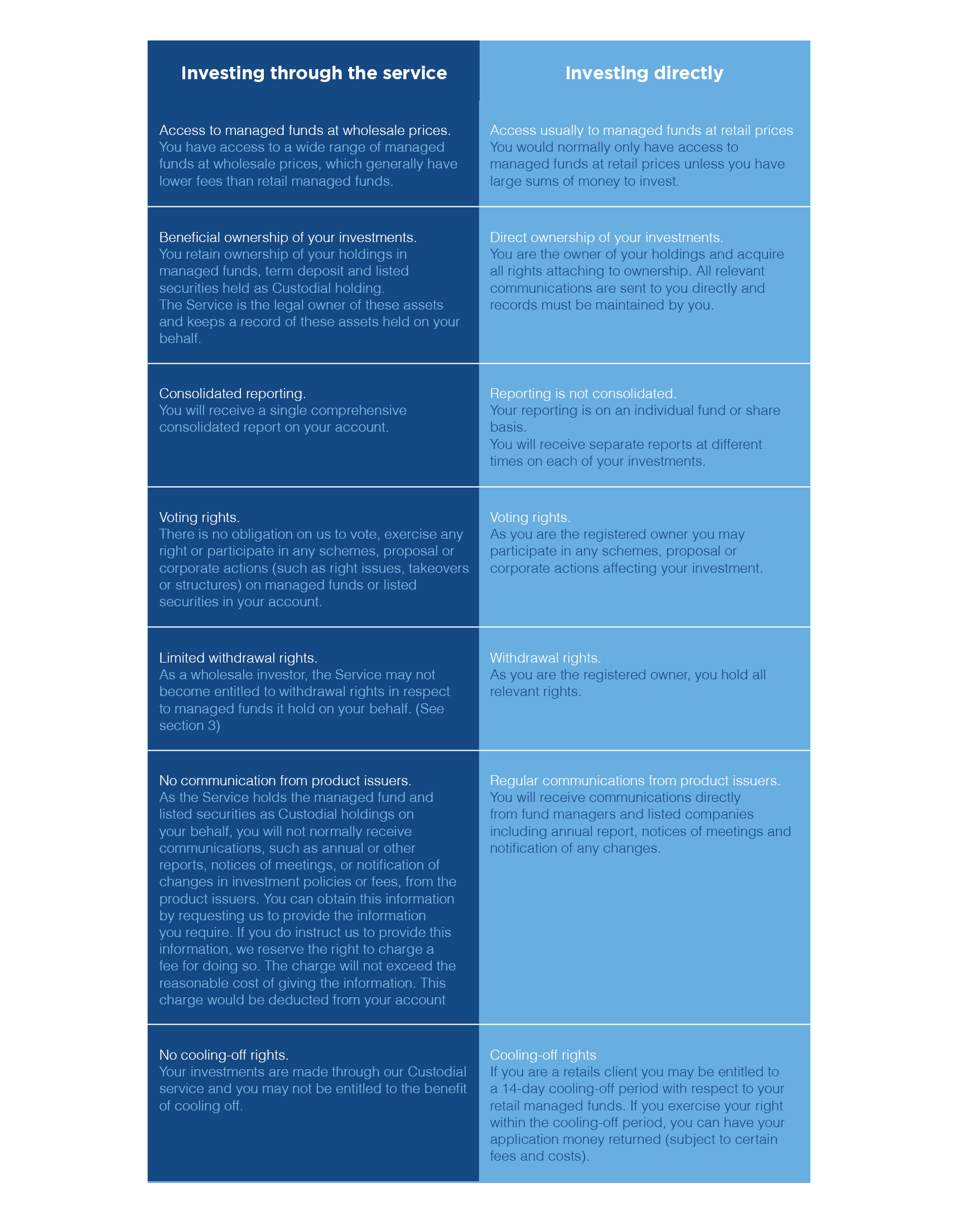

Investing in the Service is different from investing directly.

Who can use the Fiducian Investment Service?

As well as personal investor clients, the service is also available to joint investors, companies, partnerships, trusts and self-managed super funds.

Need more information?

Read the latest performance report