Overview

Two Federal Budgets in one year – what a treat!

Nearly a decade after Labor’s last Budget, Jim Chalmers delivered his first Budget with only a few new proposals that may impact the financial planning space. Most of the relevant proposals were announced before Budget night, with many already in Bills making their way through parliament.

The Budget indicates the Government’s position on some unlegislated proposals announced by the former Coalition Government (most of which you would have probably forgotten about!). Unfortunately, the outstanding 2021/22 Budget proposal that would allow the commutation of certain legacy pensions for a limited two-year window was not mentioned.

This analysis summarises the Budget proposals relevant to the financial planning space.

1. Superannuation

1A. Proposed three-year SMSF audit cycle axed

The Government has confirmed that the proposed unlegislated 2018/19 Budget measure to change the annual audit requirement for certain SMSFs to a three-year cycle will not be proceeding.

1B. Proposed relaxation of SMSF residency requirements deferred

Proposed start date: The income year commencing on or after the date of Royal Assent of the enabling legislation.

The Government has confirmed that the proposed unlegislated 2021/22 Budget measure to relax the residency requirements for SMSFs and small APRA funds (SAFs) will be deferred. Originally intended to commence on July 1, 2022, with that date now passed, the proposed start date will be the income year commencing on or after the date of Royal Assent of the enabling legislation.

Whilst this announcement confirms that this measure is still on the Government’s agenda, there’s currently no legislation in parliament (or even draft legislation that has been released for consultation), so watch this space.

If legislated, the proposal would see:

- the safe harbour rule under the Central Management and Control test for SMSFs increased from two years to five years, and

- the active member test abolished.

1C. Downsizer contribution eligibility age reduction to 55

Proposed start date: The first January 1, April 1, July 1, or October 1, to occur after the enabling legislation receives Royal Assent.

The Government confirmed its commitment to reduce the downsizer contribution age from 60 to 55.

A Bill to give effect to this change is currently before parliament (not yet passed at the time of writing). Regulations have also been registered to amend the super contribution acceptance rules to facilitate the change if the Bill passes.

This measure will allow clients to access downsizer contributions at an earlier age. However, they will need to consider future access as the contribution will be preserved until a condition of release is met, which could be a considerable period of time. Furthermore, making a downsizer contribution is a ‘once only’ opportunity. Even though a client may be able to make a downsizer contribution at an earlier age, it might be better to save this provision for the future sale of an eligible property (perhaps when the client has reached age 75 and can’t make other personal contributions).

2. Social Security

2A. Extension of the Paid Parental Leave scheme

Proposed start date: See below.

The Government announced in the lead-up to the election that it would increase the length of the Paid Parental Leave (PPL) period and improve the flexibility of the scheme.

The Paid Parental Leave scheme currently consists of two payments - Parental Leave Pay (PLP) and Dad & Partner Pay (DaPP). PLP is paid to the birth parent for up to 18 weeks at the national minimum wage ($812.45 per week for 2022/23). DaPP is paid to eligible fathers and partners for up to two weeks at the same rate. Both payments are subject to an income test that considers the claimant’s income, usually in the previous financial year. A work test and residency conditions also apply.

The Government provided some additional details in the Budget. Here’s what we know so far:

From July 1, 2023:

- Parental Leave Pay and Dad and Partner Pay will be combined into a single 20-week payment;

- The scheme will be made more flexible. Either parent will be able to claim the payment, and both birth parents (and non-birth parents) will be able to receive the payment if they meet eligibility requirements;

- Parents will be able to take the leave in small blocks (as little as a day at a time) with periods of work in between. There will be flexible weeks and use-it-or-lose-it weeks;

- Eligible single parents will benefit from the full 20 weeks;

- A $350,000 family income test will be introduced. Families will be able to choose to be assessed under this test if they don’t meet the individual income test (currently up to $156,647);

- Fathers or partners will be eligible to receive payment, irrespective of whether the birth parent meets the residency requirements;

- There will be no restriction on fathers and partners accessing any part of the leave at the same time as employer-funded leave (this is currently not permitted with the DaPP).

An additional two weeks of payment will become available on July 1, 2024. This will then be increased by two weeks each financial year until a period of 26 weeks is reached on July 1, 2026.

Legislation will be required to implement the above proposals.

2B. Increase in the rate of certain DVA disability payments

Proposed start date: January 1, 2023.

The Department of Veterans’ Affairs (DVA) Disability Compensation Payment (formerly known as the DVA Disability Pension) is designed to compensate veterans for injuries or diseases caused or aggravated by war or defence service on behalf of Australia before July 1, 2004. The Military Rehabilitation and Compensation Act 2004 (MRCA) provides compensation for injuries and diseases suffered after this date.

The Government has proposed to increase the following rates by $1,000 per annum permanently:

- Disability Compensation Payment – Special TPI rate, Temporarily Total Incapacitated (TTI) rate and blind rate; and

- Military Rehabilitation and Compensation Act – Special Rate Disability Pension rate.

Legislation will be required to implement the above proposal.

2C. Previous proposed measures axed

The Government has announced that the following unlegislated proposals from the former Coalition Government will not be proceeding:

- a consistent four-week Newly Arrived Residents Waiting Period across relevant payments (2021/22 Budget),

- the extension of the liquid assets waiting period from a maximum of 13 weeks to a maximum of 26 weeks (2017/18 Budget),

- changes to the qualifying residency period for the Age Pension and Disability Support Pension (2017/18 Budget), and

- changes to the Pension Supplement for permanent departures overseas and temporary absences (2016/2017 MYEFO).

2D. Changes to the Child Care Subsidy

Proposed start date: July 1, 2023.

The Government confirmed its commitment to making childcare more affordable via changes to the Child Care Subsidy.

A Bill to give effect to these changes is currently before parliament (not yet passed at the time of writing).

Broadly speaking, if legislated:

- Families with income up to $80,000 p.a. will be able to access a CCS rate of 90% (currently 85%);

- The CCS rate for families earning over $80,000 p.a. will taper down by one percentage point for each additional $5,000 of family income until it reaches 0% for families earning $530,000 (new CCS base rate);

- The existing measure that provides a higher CCS rate to families with multiple children aged five or under in care will be retained. For second and younger children aged five or under in care, families will receive an additional 30% up to a maximum of 95%, which will continue to apply on top of the former CCS base rate. Families will be entitled to the higher CCS rate up until a family income of $356,756 (2022/23). If families earn $356,756 (2022/23) or higher, all children in the family will be entitled to the new CCS base rate until it reaches 0% entitlement at $530,000.

The Government estimates that 96% of families with children in early childhood education and care will benefit from these reforms, and no family will be worse off^.

^ Source: Women’s Budget Statement.

2E. Reduced general patient charge for Pharmaceutical Benefits Scheme (PBS) medications

Proposed start date: January 1, 2023.

The Government confirmed its commitment to reduce the general patient charge (co-payment) on medications listed under the PBS by $12.50 from $42.50 to $30.

A Bill to give effect to this change is currently before parliament (not yet passed at the time of writing).

2F. Temporary increase to the social security work bonus income concession bank and other measures to support older Australians to continue in the workforce

Proposed start dates: Work bonus: December 1, 2022, if the enabling legislation receives Royal Assent (RA) before November 25, 2022. Otherwise, the seventh day after the enabling legislation receives RA.

Other changes: The later of January 1, 2023, and the day after the end of the period of one month beginning on the day the enabling legislation receives RA.

The Government confirmed its commitment to:

- provide a one-off $4,000 credit to a person’s work bonus income concession bank for eligible social security and DVA recipients (to be used before June 30, 2023),

- make it easier for people to get back on their Age Pension if it is cancelled due to employment income, and

- allow people to retain their Pensioner Concession Card for up to two years when their underlying payment is cancelled due to employment income.

A Bill to give effect to these changes is currently before parliament (not yet passed at the time of writing).

2G. Lifting the income thresholds for the Commonwealth Seniors Health Card (CSHC)

Proposed start date: Seven days after Royal Assent.

The Government confirmed its commitment to increase the (CSHC) income thresholds from $61,284 to $90,000 for singles, from $98,054 to $144,000 for couples (combined), and from $122,568 to $180,000 for illness-separated couples (combined).

A Bill to give effect to this change is currently before parliament (not yet passed at the time of writing).

2H. Incentivising pensioners to downsize

Proposed start date: The later of January 1, 2023, and one month after the enabling legislation receives Royal Assent.

The Government confirmed its commitment to encourage pensioners to downsize their homes by providing the following social security concessions:

- Extending the assets test exemption from 12 months to 24 months for sale proceeds from the principal home which a person intends to use to build, repair, or renovate another principal residence or to purchase another residence that is to be their principal home; and

- Applying the lower deeming rate to the principal home sale proceeds held as financial investments during the asset test exemption period.

A Bill to give effect to these changes is currently before parliament (not yet passed at the time of writing).

2I: Freeze deeming rates at current levels until June 30, 2024

Effective date: From July 1, 2022.

The Government has reiterated its commitment to freeze deeming rates at the current level until June 30, 2024.

Therefore, the lower deeming rate will remain frozen at 0.25%, and the upper rate will remain frozen at 2.25%.

3. Taxation

3A. Fringe benefits tax exemption for certain zero and low-emission cars

Proposed start date: Fringe benefits provided on or after July 1, 2022, for eligible cars that are first held and used on or after July 1, 2022.

The Government confirmed its commitment to provide an FBT exemption to employers who provide their employees with a zero or low-emission car for their private use. To qualify for the proposed exemption, the value of the car at first retail sale must be below the luxury car tax threshold for fuel-efficient cars (i.e. $84,916 for 2022/23).

The following cars will be eligible for the exemption:

- battery electric cars,

- hydrogen fuel cell electric cars, and

- plug-in hybrid electric cars.

A Bill to give effect to this change is currently before parliament (not yet passed at the time of writing).

4. Housing

4A. Improving home ownership

Proposed start dates: See below.

The Government has confirmed its commitment to various housing measures announced during the election campaign, including:

- A Help to Buy scheme that will assist low to moderate income earners to purchase a new or existing home with an equity contribution from the Government. The proposed start date for the scheme is to be confirmed.

- Establishing the Regional First Home Buyers Guarantee to support eligible people who have lived in a regional location for more than 12 months to purchase their first home in that location with a minimum five per cent deposit. Only 10,000 places will be available in the scheme per financial year until June 30, 2026. This scheme is similar to the existing First Home Guarantee and Family Home Guarantee. The proposed start date for the scheme is October 1, 2022.

Legislation will be required to implement the above proposals.

5. Other

5A. Increase in the value of a penalty unit

Proposed start date: January 1, 2023, for offences committed after the legislative amendment comes into force.

Penalty units are used to define the amount payable for offences under various Commonwealth laws. We typically see them in relation to offences under the tax and super law.

The value of a penalty unit is proposed to increase from $222 to $275. Penalty units will continue to be indexed every three years as per the pre-existing schedule, with the next indexation to occur on July 1, 2023.

5B: Fighting online scams

Proposed start date: To be confirmed.

The Government has announced that it will provide $12.6 million over four years from 2022/23 to combat scams and online fraud to protect Australians from financial harm.

These funds will be used to:

- establish a National Anti-Scam Centre,

- provide specialist identity support services, including counselling and identity recovery services for victims of identity theft, and

- raise public awareness of the risk of scams.

This is a welcome move given the recent cases of identity theft and people being scammed out of their super or investments.

6. What wasn’t mentioned?

As anticipated, the stage three tax cuts legislated to commence on July 1, 2024, weren’t mentioned in the Budget. However, that’s not to say that they will survive the next two budgets before commencement.

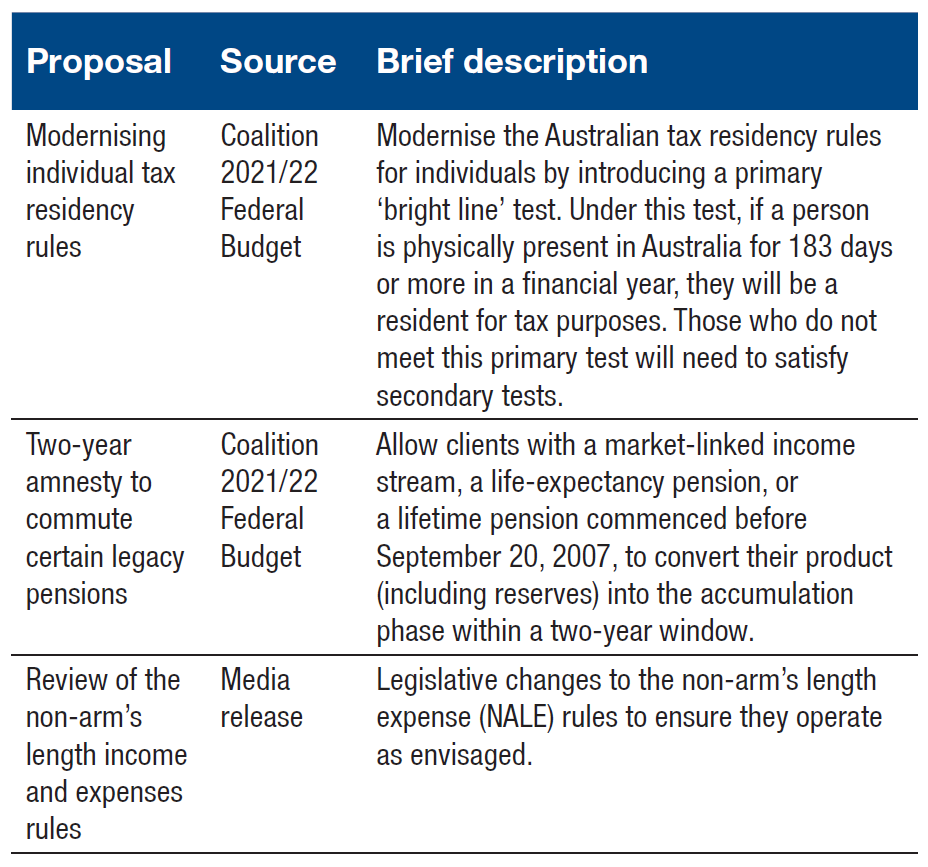

The following table contains a list of unlegislated proposals from the former Coalition Government that also weren’t mentioned in this Budget. At this stage, it is unknown whether the Government will progress with these proposals:

Disclaimer

This information has been provided by Fiducian Financial Services Pty Ltd ABN 46 094 765 134 of Level 4, 1 York Street, Sydney, NSW 2000, AFSL 231103. Any advice in this document is general in nature and does not take into account your objectives, financial situation or needs. You should receive financial advice relevant to your circumstances before making any decisions.