You may be one of the people made redundant as a result of organisational changes by your employer. If so, you may experience a range of emotions from shock and anger to relief and hope. On the flip side, the change can be the start of new possibilities such as a career change, the chance to reskill or retrain or the ability to take a well-deserved break or holiday.

The redundancy may provide you with a substantial financial windfall if you have been a long term employee. But careful consideration should be given to how best to use the redundancy payments to protect your future.

It is important to understand the payments you are receiving, the tax implications and the choices available to you. Payments received as part of a genuine redundancy program can be concessionally taxed to help your money last longer.

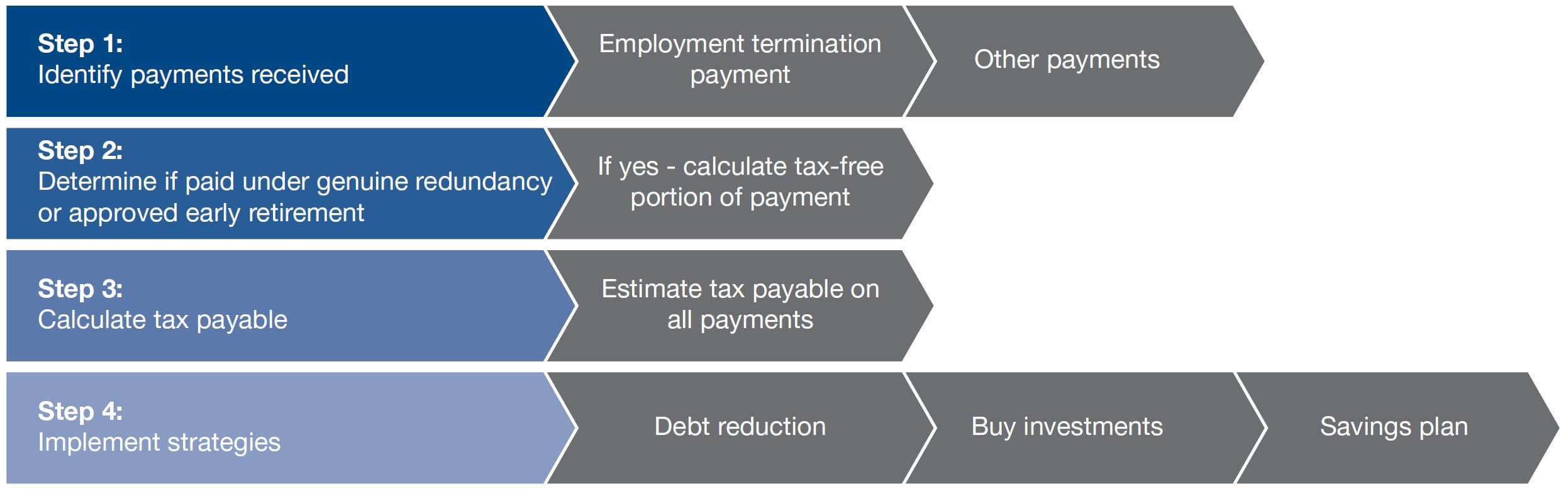

The steps you should consider for dealing with your redundancy are illustrated in the diagram below:

Let’s look at these steps in more detail.

Employment termination payment

When you cease employment, the lump sum paid by your employer may comprise a number of payments. The first step is to identify which parts are included in the definition of an employment termination payment (ETP), and which are not.

| Amounts potentially included in the employment termination payment | Amounts NOT included in employment termination payments |

|---|---|

| Unused rostered days off (RDOs) | Unused annual leave and/or leave loading |

| Payments in lieu of notice | Unused long service leave |

| Unused sick leave | Salary, wages, and allowances owing to the employee for work done or leave already taken |

| A gratuity or golden handshake | Compensation for personal injury |

| Compensation for loss of job | An advance or loan |

| Genuine redundancy and approved early retirement scheme payments above the tax-free amount | The tax-free portion of a genuine redundancy or approved early retirement scheme payment |

The next step is to calculate the tax on each payment so you can determine the net amount remaining after tax.

Taxation of employment termination payments

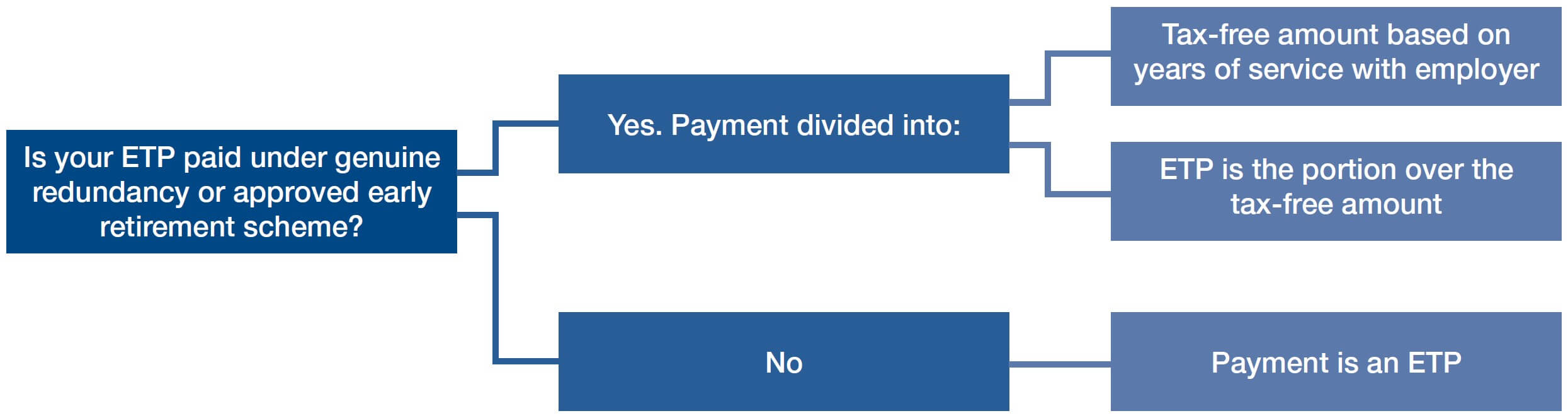

If you receive amounts classified as an employment termination payment under a genuine redundancy or approved early retirement scheme, part of the payment may be tax-free based on the number of years with that employer. To receive some of the payment tax-free, you need to be under Age Pension age when your employment was terminated.

For 2021/22 the tax-free amount is: $11,341 + [$5,672 x each completed year of employment]

In addition, if you were employed by your employer before 1 July 1983 or leave employment due to invalidity, the ETP may include a further tax-free component.

The remaining balance is an ETP that is taxable. The ETP must be taken in cash, and lump sum tax is deducted by your employer. The tax deducted depends on your age, as shown in the table below for 2021/22.

| Employment termination payment | Amounts up to $225,000 | Amounts over $225,000 |

|---|---|---|

| Under preservation age | 30%* | 45%* |

| Over preservation age during the year | 15%* | 45%* |

Taxation of unused leave payments

Unused annual leave and long service leave payments are not part of the ETP but may still receive concessional tax treatment if received due to redundancy or approved early retirement.

The payments are included in your assessable income, but the tax is limited to the rates shown in the tables below. However, as they are included in assessable income, they may impact your entitlements to other tax offsets or benefits. The following rates of tax are deducted by your employer.

| Leave payment | Proportion | Tax |

|---|---|---|

| Unused long service leave | Pre 16 August 1978 proportion | 5% is included in your assessable income and taxed at your marginal rate* |

| Post 15 August 1978 proportion | 100% is included in your assessable income and taxed at 30%* | |

| Unused annual leave | All amounts | 100% is included in your assessable income and taxed at 30%* |

The impact on Centrelink

Before making plans for spending the money, you should also consider the future and your prospects for returning to work.

The payments received may create a ‘waiting period’ during which you will either not qualify for any income support from Centrelink or qualify for a reduced amount. This can be a substantial period of time, so you need to ensure you have access to money to meet your living expenses during this time.

The upside of redundancy

If you plan ahead and use the redundancy payments wisely, you can take some of the stress out of redundancy. Some options available to you include:

- Repaying debt: Use your net redundancy payment to reduce the burden of outstanding debt. This can include paying down your mortgage, personal loans and credit card debt.

- Commence a savings strategy: You can use part of your net redundancy payments to commence a savings plan to meet your medium to long term objectives.

- Buy an investment: This can be an opportunity to invest in an asset that has the potential to provide you with a combination of capital growth and income over the long term. This may include purchasing a property or a portfolio of diversified growth assets.

Redundancy can be a challenging time but don’t lose sight of the significant upside that it can also provide with careful planning and advice.