Rewards for patience

There is often a great deal of ‘noise’ associated with investing in equities, due to constant news flow, short term volatility and the occasional large pullbacks in financial markets. But for investors who are prepared to be patient, the rewards of exposure to this asset class can be seen over the longer term. Using the last 40 years of data from the ASX, it has not been possible to generate a negative return from the market with a holding period of 10 calendar years, and the longer an investment in equities (index return) is held, the smaller the range of potential returns.

Time is on your side

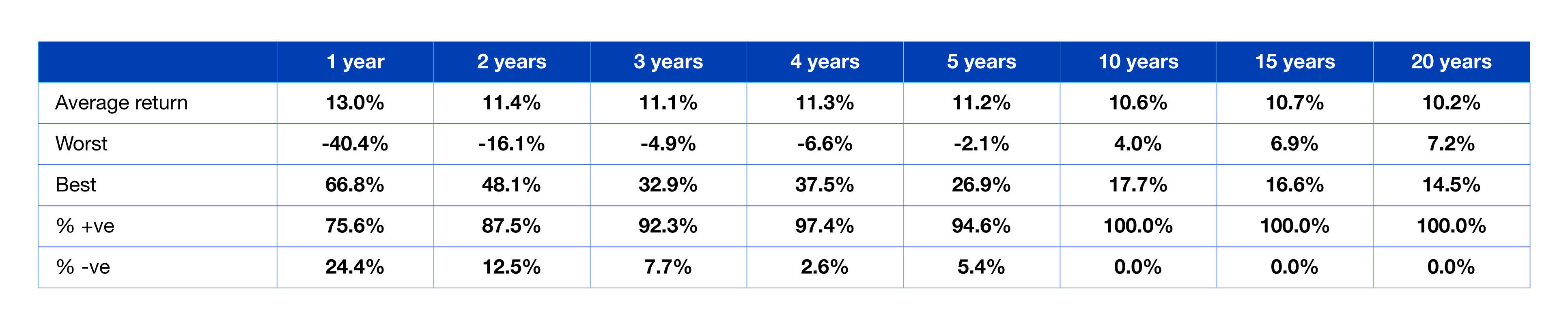

The table below summarises the last 40 years of returns data for the All Ordinaries Accumulation Index to the end of 2020, and looks at the returns received for various holding periods. For example, the ‘5 years’ column calculates the returns for each rolling five year return in the series:

Source: ASX, Fiducian 2021

A couple of points to note. Firstly, the longer the time period, the less likely you are to experience a negative return. Over one calendar year, returns have been positive about 75% of the time. By the time you have held for five calendar years, returns have been positive 95% of the time. And for ten calendar years and beyond, there is no point where you could have invested in the index and finished with a negative return over the last 40 years.

Secondly, the longer you hold, the smaller the dispersion of returns. The returns for a one year holding period range from -40.4% to +66.8%. By the time this is extended to ten years, the range has narrowed to +4.0% to +17.7%. The longer an investment is held in the market, the range of realised returns becomes narrower.

The value of good advice

Individual investors do need to be aware of their own behavioural biases when investing, as long term data shows that over-trading and following short term trends has resulted in long term performance for the average investor that is below index. During the most recent significant market falls in 2020, shown in the ASX Australian Investor Study 2020, investors who received professional advice were more likely to increase their investments in equities at a low point in the market as opposed to those who did not receive professional advice.

The ASX Investor Study 2020 also tells us that unlike previous cycles, more investors decided to shift money to riskier investments when markets were weak as opposed to selling.

The clear majority of respondents reported either increasing allocations to risky investments or investing all spare cash as opposed to moving to safer investments or completely liquidating and moving to cash.

There was a marked difference between advised and non-advised individuals. Non-advised individuals were more likely to liquidate their holdings (4% vs 1%) or increase allocations to cash (14% vs 12%). Advised individuals were more likely to invest all spare cash (26% vs 16%) and shift to a riskier allocation (6% vs 1%).

Whether or not this behaviour will be seen again in future market pullbacks, or is simply reflective of locked down individuals with spare time and money to speculate on stocks, as some have suggested, remains to be seen.