Superannuation Service

The Fiducian Superannuation Service is a streamlined superannuation master trust designed to help you build and manage your wealth before and after retirement. Its flexible structure allows you to implement the investment strategies that suit your risk requirements, investment time frame and growth and income needs.

Fiducian Superannuation fund

The Fund is a public offer superannuation fund, regulated by the Australian Prudential Regulation Authority, with a corporate trustee, Fiducian Portfolio Services Limited, whose Directors bring a wealth of experience and expertise to the Trustee Board.

The Fund offers a wide range of superannuation investments to cater for all types of investors, from the young person starting out in their first job, to those building wealth, contemplating retirement or already retired.

You can simply ask your employer to direct your ongoing compulsory employer contributions (and any contributions you make yourself) into your Fiducian account.

You also have a range of insurance options to choose from, providing you and your family with additional financial security.

To access the Fiducian Superannuation Service, you should seek the advice of a financial adviser.

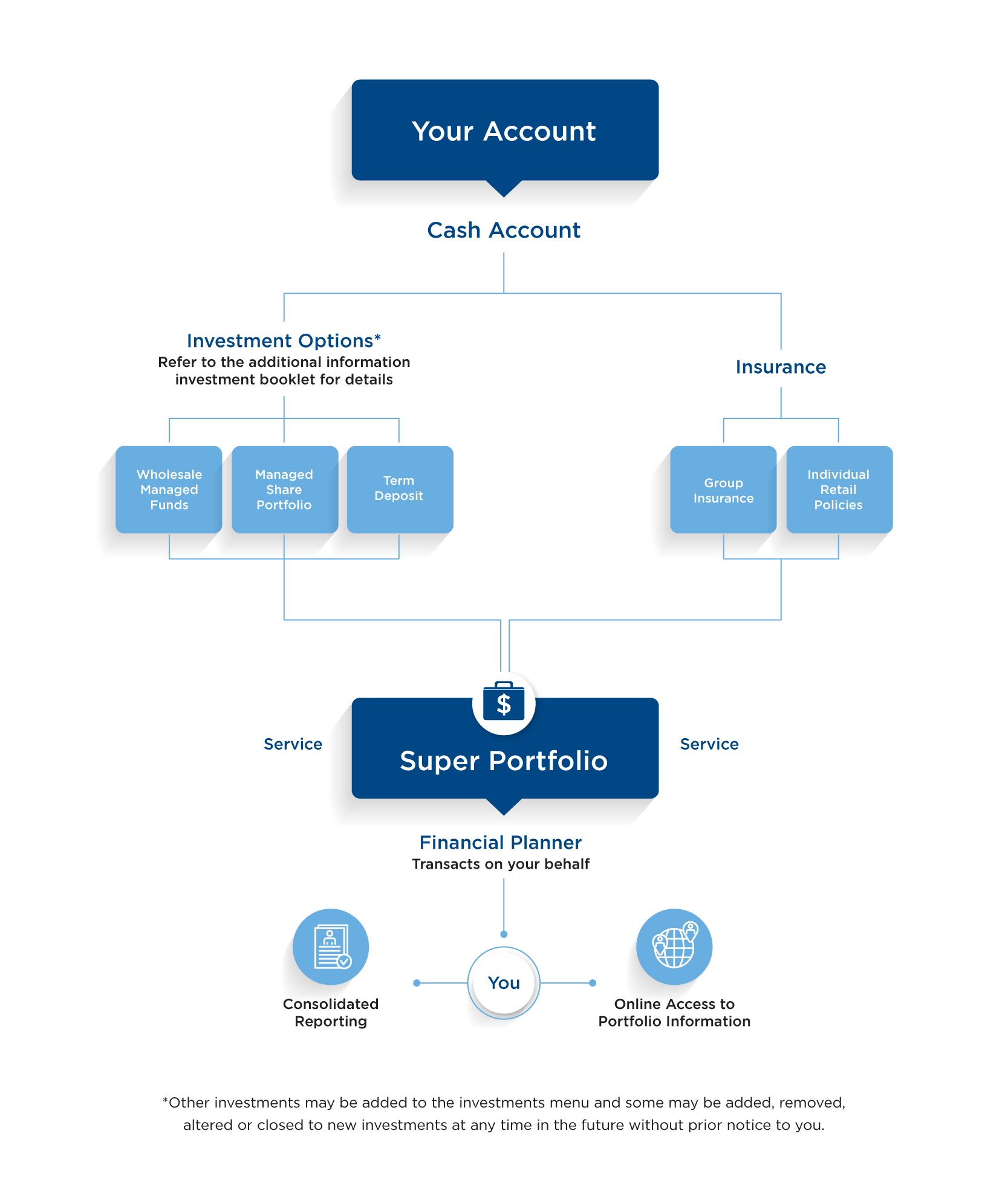

How does the Fiducian Superannuation Service work?

As an investor within the Fiducian Superannuation Service, you’ll have access to an online reporting system Fiducian Online that is readily accessible, comprehensive and easy to use. This allows you to keep track of your investments as regularly as you like.

Your Financial Adviser could also transact on your behalf.

Features and benefits of the Fiducian Superannuation Service

- Manage all your super investments in one location

- You and your Financial Adviser can tailor a strategy to suit your exact needs

- Cost savings on investment and other fees

- A wide range of investment options

- 24/7 online access and consolidated reporting

- Multiple insurance options

- Income options including high interest cash account and term deposits

- Account-based pension and term allocated pension portfolios to receive regular tax-effective retirement income

What investment options are available?

The Trustee carefully researches and selects a team of specialist managers according to stringent criteria to support overall performance and investment diversification.

The investment menu comprises:

- Over 35 managed funds options from over 18 investment managers, including renowned experts such as BT, Platinum and Colonial First State

- Access to 14 Fiducian Funds managed through our proven Manage the Manager System

- Managed share and listed property securities portfolios fully researched and managed for you

- Fixed interest securities and term deposits.

Disclaimer:

Information on this website is intended to be general information only and does not constitute investment or financial product advice. It does not take into account any person's objectives, financial situation or needs. You should conduct your own investigation or consult a financial adviser, and consider the relevant Target Market Determination (TMD) and Product Disclosure Statement (PDS) before making a decision about whether to acquire or continue to hold any financial product.

Issued by Fiducian Portfolio Services Limited ABN 13 073 845 931, AFSL 231101, as the Trustee of the Fiducian Superannuation Fund ABN 57 929 339 093.

Need more information?

The links below provide more details about the investment menu, how the Fiducian Superannuation Service works, and about super generally. Of course, your Financial Adviser is happy to answer any questions you may have.

Fiducian Superannuation Service – Product Disclosure Statement (PDS)

Additional Information Booklet

Fund governance

The Fiducian Superannuation Service is a public offer superannuation fund regulated by the Australian Prudential Regulation Authority, with a corporate trustee, Fiducian Portfolio Services Limited.

Find a Financial Adviser near you