Diversified Funds

Fiducian’s four highly rated diversified funds provide investors with the proven benefits of diversification across asset sectors and between fund manager styles within each sector.

Fund asset classes

Each fund is built from a blend of the following asset classes:

- Australian equities (shares)

- International equities

- Listed property

- Fixed interest

- Cash

On this page

Fiducian Capital Stable Fund

The Fund is one of Fiducian’s diversified funds suitable for investors seeking a relatively high level of income supplemented by a modest level of capital growth. The bulk of the portfolio is held in the fixed interest and cash sector to reduce the likelihood and frequency of negative returns over a single year period. However, some exposure to shares for long- term performance is also included.

The Fiducian Capital Stable Fund is a diversified fund. The Fiducian Investment Team makes active tactical asset allocation decisions within the Fiducian diversified funds, both between managers as well as between asset classes. These decisions are the culmination of strategic decisions taken by the Investment Team based on detailed economic, market and fund performance analysis.

The Fiducian Manage the Manager System is based on the principle that several carefully selected investment managers can, over any reasonable period, produce a better result, more consistently and with lower volatility, than a single manager. Fiducian has carefully selected a panel of investment managers for each of a wide range of asset sectors. The fund manager selection process involves the application of quantitative and qualitative analysis to identify top performing funds, managed by competent and experienced investment teams, who are assessed as being able to achieve consistently good performance over time without taking excessive risks.

Who would the Fiducian Capital Stable Fund suit?

The Fiducian Capital Stable Fund is likely to be suitable for investors who can hold investments for two to three years at least, who are relatively conservative, but are prepared to take some risk by investing a small portion of their assets in Australian and international share funds and property.

Disclaimer:

Information on this website is intended to be general information only and does not constitute investment or financial product advice. It does not take into account any person's objectives, financial situation or needs. You should conduct your own investigation or consult a financial adviser, and consider the relevant Target Market Determination (TMD) and Product Disclosure Statement (PDS) before making a decision about whether to acquire or continue to hold any financial product.

The Responsible Entity for Fiducian Funds is Fiducian Investment Management Services Limited ABN 28 602 441 814 AFSL 468211.

Fiducian Balanced Fund

Investing in a ‘Balanced Structure’ means that your money is diversified over a number of asset sectors. The key reason for diversification is that financial markets can change without warning, which means there is a chance that your assets may decline in value just when you need them. By diversifying investments, you have a better chance of cushioning your assets from financial market declines and, as well, be able to capture the growth that comes from financial market appreciation.

Who would the Fiducian Balanced Fund suit?

This fund is suitable for investors who are prepared to hold their investment for a period exceeding 5 years. Investors might hold this fund as a core part of their portfolio as it gives exposure to growth assets, as well as to defensive assets.

Benefits of investing in the Fiducian Funds

The Fiducian Balanced Fund has been constructed to diversify your investments across a number of asset sectors, including Australian Shares, International Shares, Listed Property Securities, Australian Fixed Interest, Inflation linked Fixed Interest, International Fixed Interest and some cash. Fiducian has twenty-four (24) different fund manager teams managing your money each within a distinct range around a benchmark in the Balanced Fund. In each asset sector, Fiducian continually monitors the fund managers and alters individual manager weightings when necessary and also manages tactical asset allocation between asset sectors based on its analysis of changes in the economic climate in Australia and globally.

The Fiducian Balanced Fund received a 5-Star Overall Morningstar RatingTM.1

1 As of 30 November 2021, The Fiducian Balanced received a 5-star Overall Morningstar RatingTM out of 200 Multi-Sector Growth Funds. View full Morningstar disclaimer here. Past performance is not a reliable indicator of future performance. The Morningstar Rating is an assessment of a fund’s past performance – based on both return and risk – which shows how similar investments compare with their competitors.

Disclaimer:

Information on this website is intended to be general information only and does not constitute investment or financial product advice. It does not take into account any person's objectives, financial situation or needs. You should conduct your own investigation or consult a financial adviser, and consider the relevant Target Market Determination (TMD) and Product Disclosure Statement (PDS) before making a decision about whether to acquire or continue to hold any financial product.

The Responsible Entity for Fiducian Funds is Fiducian Investment Management Services Limited ABN 28 602 441 814 AFSL 468211.

© 2021 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘regulated financial advice’ under New Zealand law has been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. For more information, refer to our Financial Services Guide (AU) or Financial Advice Provider Disclosure Statement (NZ) at www.morningstar.com.au/s/fsg.pdf and www.morningstar.com.au/s/fapds.pdf . You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser.

Fiducian Growth Fund

Fiducian’s Growth Fund is a carefully structured fund that combines allocation to a number of different asset sectors but with an emphasis on growth assets. This fund has been one of the best performing diversified funds. Independent agency Morningstar’s Investment Performance Survey reported the Fiducian Growth Fund ranked 1st out of 187 funds over Five years performance.1 The Fiducian Growth Fund is intended to have a relatively higher exposure to shares than either the Fiducian Capital Stable Fund or the Fiducian Balanced Fund and therefore should be capable of generating higher returns over the longer term, but it will also be exposed to higher capital losses when markets fall.

1 As of 30 November 2021, Past performance is not a reliable indicator of future performance.

Who would the Fiducian Growth Fund suit?

The Fiducian Growth Fund is suitable for investors seeking good long-term capital growth with possible short-term volatility. Investors should be prepared to hold their investment for periods exceeding five years. Holdings include international and Australian shares, property, fixed interest and liquid assets.

Benefits of Investing in the Fiducian Growth Fund

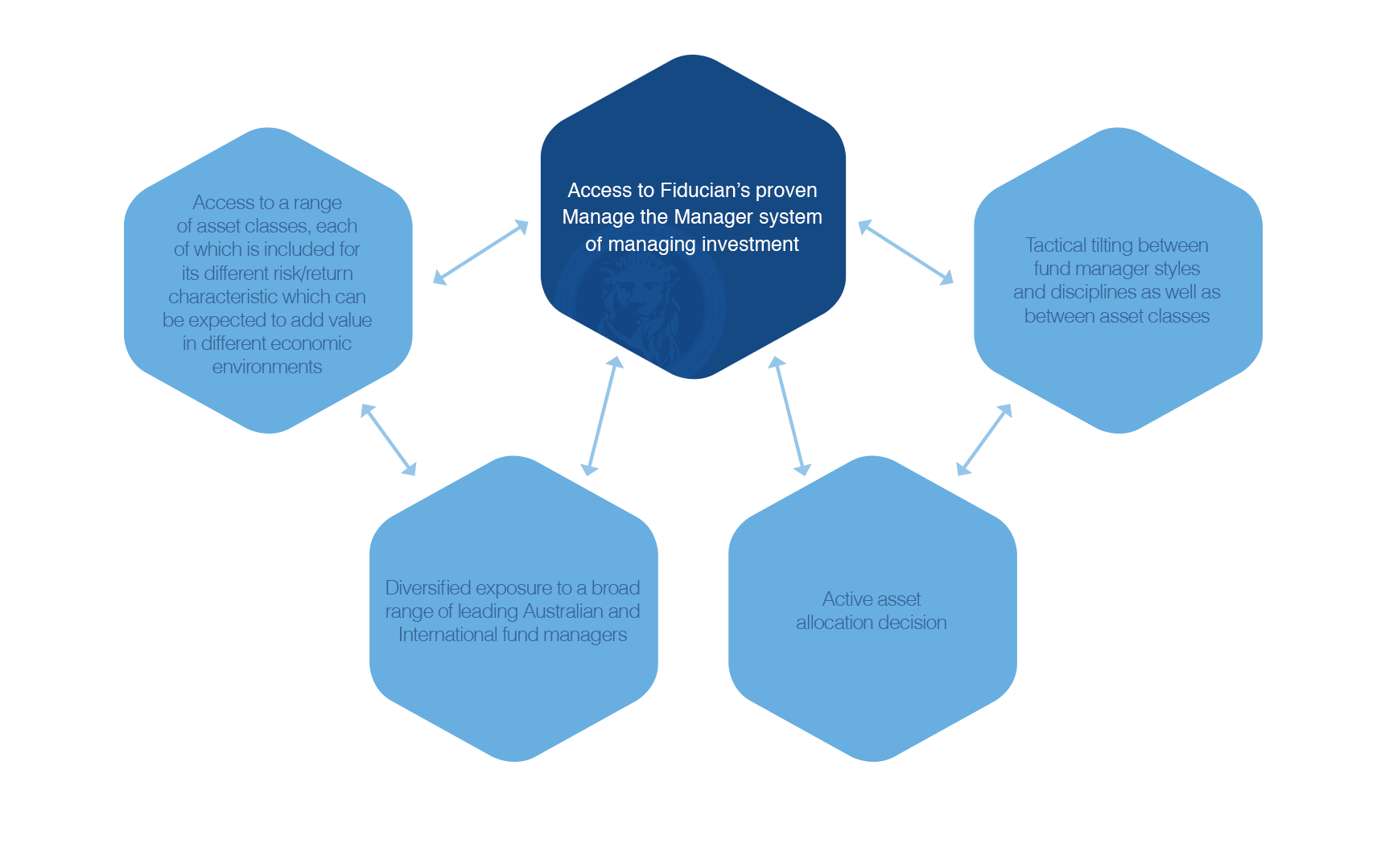

The key benefits of investing in the Fund for you and your Financial Adviser are:

• Access to Fiducian’s proven Manage the Manager System of managing investments

• Access to a range of asset classes, each of which is included for its different risk/return characteristics which can be expected to add value in different economic environments

• Diversified exposure to a broad range of leading Australian and international fund managers

• Active asset allocation decisions

• Tactical tilting between fund manager styles and disciplines as well as between asset classes

Disclaimer:

Information on this website is intended to be general information only and does not constitute investment or financial product advice. It does not take into account any person's objectives, financial situation or needs. You should conduct your own investigation or consult a financial adviser, and consider the relevant Target Market Determination (TMD) and Product Disclosure Statement (PDS) before making a decision about whether to acquire or continue to hold any financial product.

The Responsible Entity for Fiducian Funds is Fiducian Investment Management Services Limited ABN 28 602 441 814 AFSL 468211.

© 2021 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘regulated financial advice’ under New Zealand law has been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. For more information, refer to our Financial Services Guide (AU) or Financial Advice Provider Disclosure Statement (NZ) at www.morningstar.com.au/s/fsg.pdf and www.morningstar.com.au/s/fapds.pdf . You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser.

Fiducian Ultra Growth Fund

The Fiducian Ultra Growth Fund has been constructed to diversify your investment across asset sectors, including Australian Smaller Company Shares, Emerging Markets Shares, Global Smaller Company Shares, Listed Property Securities, Bio-Technology Shares and other Technology shares that include Artificial Intelligence and Robotics, as well as some cash.

Who would the Fiducian Ultra Growth Fund suit?

The fund is suitable for investors who are prepared to hold their investment for a period exceeding 5 to 7 years. Such investors are looking for superior growth in the value of their investment, but appreciate that higher returns come with higher associated risk and therefore prices can fluctuate sharply between positive and negative returns from time to time. Our diversification between various asset sectors aims to achieve relatively steadier returns (reduced risk).

Benefits of investing in the Fiducian Ultra Growth Fund

Using the Manage the Manager System of investment management for the Fiducian Funds, we invest in a blend of well-researched fund managers who are selected for their expertise and their investment styles. Fiducian has eighteen (18) different fund manager teams managing your money in the Ultra Growth Fund.

Disclaimer:

Information on this website is intended to be general information only and does not constitute investment or financial product advice. It does not take into account any person's objectives, financial situation or needs. You should conduct your own investigation or consult a financial adviser, and consider the relevant Target Market Determination (TMD) and Product Disclosure Statement (PDS) before making a decision about whether to acquire or continue to hold any financial product.

The Responsible Entity for Fiducian Funds is Fiducian Investment Management Services Limited ABN 28 602 441 814 AFSL 468211.

Benefits of investing in the Fiducian Funds

Read the latest performance report